Abstract

The assessment of earthquake and risk to a portfolio, in urban or regional scale, constitutes an important element in the mitigation of economic and social losses due to earthquakes, planning of immediate post-earthquake actions as well as for the development of earthquake insurance schemes. Earthquake loss and risk assessment methodologies consider and combine three main elements: earthquake hazard, fragility/vulnerability of assets and the inventory of assets exposed to hazard. Challenges exist in the characterization of the earthquake hazard as well as in the determination of the fragilities/vulnerabilities of the physical and social elements exposed to the hazard. The simulation of the spatially correlated fields of ground motion using empirical models of correlation between intensity measures is an important tool for hazard characterization. The uncertainties involved in these elements and especially the correlation in these uncertainties, are important to obtain the bounds of the expected risks and losses. This paper looks at the current practices in regional and urban earthquake risk assessment, discusses current issues and provides illustrative applications from Istanbul and Turkey.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

In UNISDR terminology, “Risk” is defined as “the combination of the probability of an event and its negative consequences”, and “Risk assessment” is defined as “a methodology to determine the nature and extent of risk by analyzing potential hazards and evaluating existing conditions of vulnerability that together could potentially harm exposed people, property, services, livelihoods and the environment in which they depend”.

Earthquake risk can be defined as the probable economic, social and environmental consequences of earthquakes that may occur in a specified period of time and is determined by using earthquake loss modeling procedures. In this context, the loss is the reduction in the value of an asset due to earthquake damage and risk is the quantification of this loss in terms of its probability (or uncertainty) of occurrence. In simpler terms, the “loss” is the reduction in value of an asset due to damage and the “risk” represents the uncertainty of this “loss”.

Earthquakes, which have annually caused an average of USD 34.7 billion in damages (Munich 2016), are one of the most destructive natural perils and can lead to severe economic, social and environmental impacts. Rapid urbanization and the accumulation of assets in seismic areas have led to an increase of earthquake risk in many parts of the world. The 2011 Great East Japan Earthquake was the costliest earthquake with USD 210 billion in economic losses followed by the Hanshin-Awaji earthquake (Kobe earthquake) in 1995 with USD 100 billion in economic losses (Munich 2016). Similarly, loss estimates from a 7.8 magnitude earthquake in Southern California would cause over USD 200 billion in economic losses (USGS 2008).

Public and private enterprises analyze their portfolio of assets to assess and to manage their earthquake risk. In calculating the earthquake risk of each asset, social and economic losses, due to not only physical damage to buildings and facilities but also to the non-structural damage, consequential damage and business interruption are considered. In insurance terminology, these risk assessments and estimations are called as the Catastrophe (or simply, “Cat”) Modeling. Insurance companies use these cat models for insurance pricing, portfolio management, to monitor their capital requirements and solvency and to determine their reinsurance needs. Cedents can use the cat models to assess the appropriate structure of their outwards program and to compare technical prices of outwards treaties to market prices.

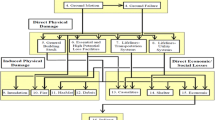

The components of earthquake risk estimation can be addressed following the modular structure of the HAZUS methodology (Whitman et al. 1997; Kircher et al. 2006; FEMA 2003) illustrated in Fig. 6.1.

Earthquake risk estimation (after HAZUS-MH, FEMA 2003)

For a given inventory of elements (location and physical characteristics) exposed to seismic hazard, the important ingredients of this earthquake risk estimation flowchart are Ground Motion, Direct Physical Damage, Induced Physical Damage, and Direct/Indirect Socio-Economic Losses.

Almost all earthquake risk assessment schemes rely on the quantification of the earthquake shaking as intensity measure parameters using probabilistic or deterministic earthquake hazard models. For a given ground motion (intensity measure) the direct physical damage is determined by the fragility/vulnerability relationships that provide the probability of damage/loss, conditional on the level of intensity measure. Each step of the process incorporates stochastic or random variation associated with all aspects of the modeled phenomenon. Consequently, the earthquake risk estimations should consider the uncertainties in these steps.

In 1990, under the UN-IDNDR (International Decade for Natural Disaster Reduction) program the RADIUS (Risk Assessment Tools for the Diagnosis of Urban Areas against Seismic Disasters) project promoted the earthquake risk assessment and mitigation in the international scale (UNISDR 2000). One of the most used methodologies of earthquake risk assessment originate from HAZUS (www.fema.gov/hazus) where, HAZUS-MH MR4 is a damage- and loss-estimation software developed by FEMA to estimate potential losses from natural disasters. The World Bank’s CAPRA (http://www.ecapra.org/) project has also developed the widely used probabilistic risk assessment tools and software. Besides, several European Projects have also contributed to the development of comprehensive methodologies and tools for earthquake-risk assessment. In this regard, the following projects can be cited: RISK-UE (Mouroux and LeBrun 2006); LESSLOSS (Calvi and Pinho 2004; Spence 2007, http://www.risknat.org/baseprojets/ficheprojet.php?num=55&name=LESSLOSS); SYNER-G (Pitilakis et al. 2014a, b, http://www.vce.at/SYNER-G/files/dissemination/deliverables.html) and; NERA (www.nera-eu.org).

The Seismology and Earthquake Engineering Research Infrastructure Alliance for Europe (SERA, http://www.sera-eu.org/en/home/) as a Horizon 2020-supported program, works to develop a comprehensive framework for seismic risk modelling at European scale. This risk modeling involves: European capacity curves, fragility, consequence and vulnerability models; European seismic risk results in terms of average annual loss (AAL), probable maximum loss (PML), and risk maps in terms of economic loss and fatalities for specific return periods and; Methods and data to test and evaluate the components of seismic risk models.

GEM initiative (www.globalquakemodel.org), which started in 2006 to develop global, open-source earthquake risk assessment software and tools, has contributed profoundly to the earthquake hazard and risk assessment standards, developed guidelines, the OpenQuake (www.globalquakemodel.org/openquake) software and the global earthquake hazard and risk maps (https://www.globalquakemodel.org/gem).

2 Probabilistic Earthquake Risk

Risk can generally be defined as the product of the probability of occurrence of a certain hazard with a prescribed intensity times the consequences of the asset being damaged due to that event. The simple direct way of making probabilistic estimates of damage D exceeding a damage level, d, for a given earthquake: is to express it as a function of the earthquake source, E, and the site, S, parameters (McGuire 2004).

In practice, since most of the damage is caused by ground shaking, the probability of D (i.e. seismic risk) is estimated as a function of a ground motion Intensity Measure (IM)

where:

P(D > d|IM) represents the so-called fragility function and; λ(IM > im) is the total frequency, which IM exceeds an intensity measure level “im” and, essentially, represents the seismic hazard at the site.

Yücemen (2013) has developed a discrete for the calculation of risk, in terms of Expected Annual Damage Ratio or Average Annual Loss Ratio (AALRk) for a given (kth) element of the inventory exposed to earthquake hazard.

where MDRk(IM) is the Mean Damage Ratio associated with the inventory element k for the given IM, essentially representing the discrete fragility function, and λ(IM) is the total frequency for given IM, essentially representing the seismic hazard.

where Pk(DS|IM) represents the probability for the given inventory element k at a given Damage State (DS) and constitutes the element of the Damage Probability Matrix (DPM) for the inventory element k and CDRk(DS) represents the Central Damage Ratio for the given inventory element k at the given DS. The DPM, for a given inventory element k, provides the damage probability distribution for different DS (represented by CDR) and the IM.

The development of Performance-Based Earthquake Engineering (PBEE) has created a rigorous and comprehensive framework for Probabilistic Seismic Risk Analysis (PSRA) (Cornell and Krawinkler 2000; Krawinkler 2002). This PBEE-PSRA framework is based upon a chain of four conditional random variables: the ground motion intensity measure (IM); the engineering demand parameter (EDP), the component-specific damage measure (DM or damage state DS) and, the decision variable (DV). The IM term is a quantitative measure of ground motion shaking intensity such as peak ground acceleration or spectral displacement. The EDP term is a quantitative measure of peak demand on the asset (e.g. inter-story drift ratio, peak floor acceleration for a building). The DS term represents a discrete component damage state. The Decision Variables, DV, is the outcome of the earthquake risk (such as the annual earthquake loss or the exceedance of damage limit states). These parameters are and need to be carefully defined. For example, an efficient IM should be able to predict EDPs with low uncertainty.

Estimation of the DVs involve the assessment of earthquake ground motion, analysis of the structural response and comparison of the response parameters with the performance objectives (Cornell and Krawinkler 2000). In PBEE-PSRA, the annual rate of the DV is provided by total probability integral (so-called, triple integral) provided in Eq. 6.5.

where: λ(DV) is the annual rate of exceeding the decision variable, DV;

G(DV|DM) is the probability of exceeding the decision variable given the damage measure, DM;

G(DM|EDP) is the probability of exceeding the damage measure, DM, given the engineering demand parameter, EDP;

G(EDP|IM) is the probability of exceeding the engineering demand parameter, EDP, given the intensity measure, IM, and;

λ(IM) is the annual rate of exceeding the ground motion intensity measure and;

dG(DV|DM), dG(DM|EDP)λ and dλ(IM) are the differentials of the respective terms.

The steps used in the PBEE-PSRA, as indicated in the total probability integral given by Eq. 6.5 are illustrated in Fig. 6.2 (Moehle 2003).

Steps in the PBEE-PSRA procedure (Moehle 2003)

Following processes can be distinguished in Eq. 6.5 and in Fig. 6.2:

-

Hazard Analysis represents the annual rate of exceedance of certain intensity measures (IMs), where λ(IM) quantifies the annual rate of exceeding a given value of seismic intensity measure (IM) (i.e. the outcome of the PSHA).

-

In the structural analysis, one creates a structural model of the building in order to estimate the response, measured in terms of a vector of engineering demand parameters (EDP), conditioned on seismic excitation represented by a set of IMs [G(EDP|IM)].

-

Damage Analysis yields the conditional probability function, G(DM|EDP), that relates Damage Measures (DMs) and EDP. The DM distributions are generally characterized in terms of fragility curves.

-

Loss Analysis uses Decision Variable (DV) as the random variable and produces the conditional probability function, G(DV|DM), for given DMs, to describe the earthquake risk (e.g. the annual losses, the exceedance of damage limit states).

In Eq. 6.5 all four variables (IM, EDP, DM, and DV) are continuous random variables. However, Eq. 6.5 is generally modified as the summation of discrete terms, since in the current practice; the damage measures are not continuous but rather a set of discrete damage states. The integration of scenario losses provided by the triple integral (Eq. 6.5) over the entire range of occurrence probability will result in the quantification of seismic risk in terms of the Expected Annual Loss (EAL) (Dhakal and Mander 2006).

2.1 Fragility Functions

In general, seismic fragility is defined as the probability that the damage of a structure exceeds a specific damage state “d” for a given level of seismic hazard (McGuire 2004)

Melchers (1999) provides the following expressions to define the general fragility functions.

and

where FR(x) denotes the fragility function for a specific loss for a given IM = x and λ(Loss) is the annual rate of exceedance of the specific Loss.

In PBEE-PSRA, the fragility functions are assigned for discrete damage states, to provide the probability of exceeding a damage state for a given EDP level, as shown in Eq. 6.7.

where, λ(EDP) is the annual rate of exceeding a specified demand level EDP≥edp; G(EDP|IM) is the probability of exceeding the engineering demand parameter, EDP, given the intensity measure, IM and; λ(IM) is the annual rate of exceeding the ground motion intensity measure, IM. For the assessment λ(EDP), the result of probabilistic seismic demand analysis can be used.

The conditional distribution G(EDP|IM) can also be called “Demand Fragility Function”. Similarly, the “Damage Fragility Function” and “Loss Fragility Function” corresponding, respectively to DM and DV can be derived as follows (Lu et al. 2012):

These equations can be further reduced to yield respectively the annual rate of exceeding a specified damage measure level (DM ≥ dm) and decision level (DV ≥ dv).

3 Ground Motion Intensity Measures (IM)

Estimates of damage to structures are made on the basis of a given level of ground motion intensity. The strength of an earthquake ground motion is often quantified by an IM (Baker and Cornell 2005). Macroseismic intensity and peak ground motion parameters (e.g. peak ground acceleration, velocity, and displacement, PGA, PGV and PGD, respectively) as well as the spectral acceleration/displacement at the fundamental vibration period of the structure, have been traditionally used in earthquake vulnerability assessment studies (Calvi et al. 2006). The use of a particular intensity measure for fragility or vulnerability assessment depends on the damageability characteristics of the element under the direct and indirect actions induced by an earthquake.

3.1 Ground Motion Prediction Models

Ground-motion predictive models (GMPMs) provide a probability distribution for ground motion intensity measures and are modeled in the following form (Baker 2013)

where ln(IM) is the logarithm of ground motion intensity measure that is modeled as a normally distributed random variable. The terms \(\overline {\ln \left( {IM} \right)} \left( {M,R,\Theta } \right)\) and \(\sigma \left( {M,R,\Theta } \right)\) are the predicted mean and standard deviation of the ln(IM), respectively. They are functions of magnitude, M, source-site distance, R and other estimator parameters such as rupture mechanism, soil conditions and etc. that are collectively referred in vector Θ. The parameter ε is a standard normal random variable and represents the variability in ln(IM). Positive ε produces larger than-average values of ln(IM), whereas negative ε values yield smaller-than-average values of ln(IM).

Given a ground-motion intensity measure of interest the exceedance probability of any im level is computed from the predicted mean (\(\left( {\overline {\ln \left( {IM} \right)} \left( {M,R,\Theta } \right)} \right)\)) and standard deviation (\(\sigma \left( {M,R,\Theta } \right)\)) as given below.

here, Φ() is standard normal cumulative distribution. Equation (6.13) can be alternatively written in the form of probability distribution function (fIM(u)) as in Eq. (6.14) that is generally more convenient for PSHA.

Following Jayaram and Baker (2009): the logarithm of a ground motion Intensity Measure, IMij, at a site i for an earthquake j, is modeled from Eq. (6.12).

The standard deviation in Eq. 6.14 is now decomposed into two components: σij and εij describe the within-event (inter-event) variability and, τj and ηj describe the between-event (intra-event) variability. σij and τj are intra-event and inter-event standard deviations, respectively, εij is the normalized intra-event residual at site i for earthquake j and ηj is the normalized inter-event residual for earthquake j. The total residual is the sum of inter- and intra-event residuals and the total standard deviation σΤi is given by Eq. 6.18.

3.2 Spatial Correlation of Ground Motion

It has been shown that, for a given earthquake, spatial correlation of IMs exists and it is essentially attributable to the following two sources:

-

(1)

The event-wide correlation of IMs through the between-event (intra-event) variability (i.e. a systematic lower or higher ground motion of an event, for instance, due to a higher or lower stress drop at the source) and:

-

(2)

The tendency of local IMs being lower or higher than the GMPMs predicted median, through the within-event (intra-event) variability (i.e. near-fault directivity effects and wave propagation paths). (e.g. Wang and Takada 2005; Goda and Hong 2008a, b; Jayaram and Baker 2009; Esposito and Iervolino 2011). The intra-event residuals at different sites are correlated, as a function of their separation distance. This correlation would be larger as the distance between the sites become smaller.

As such, when modeling ground motion fields for a scenario earthquake, a sample of the inter-event residuals for all the sites/cells, for the event, should be taken and combined with the intra-event residual at each site/cell, obtained through a spatial correlation model (e.g. Crowley et al. 2008).

For the estimation of the spatial correlation of ground motion IMs, semivariogram definitions are generally used (Jayaram and Baker 2009). The ηj (normalized inter-event residual for earthquake j) is a random variable that follows a standard normal distribution. The σij (normalized intra-event residual at site i for earthquake j) is a 2-dimensional random field that exhibits spatial correlation following a model semivariogram, defined as a measure of the average dissimilarity in data values as a function of the separation distance between sites. Jayaram and Baker (2009) proposed the semivariogram, ρ(h), for predicting spatial correlation of ground motions IMs with a given separation distance h.

where: a is the sill and b is the range of the semivariogram function. Both a and b factors depend on the IM calculated and the geological conditions (Fig. 6.3).

It is generally sufficient to estimate the semivariogram in order to estimate the correlation coefficient, since it can be theoretically shown that the following relationship holds between the semivariogram, γ (h), and the correlation coefficient, ρ(h), (Goovaerts 1997):

Empirical models of spatial correlation of ground motion intensity measures exist only for a few seismic regions in the world, such as Japan, Taiwan, California and Marmara Region in Turkey, since a dense observation of strong earthquake ground motion is necessary for this purpose.

Wagener et al. (2016) has studied the intra-event correlation of the earthquake ground motion using the data from Istanbul Rapid Response and Early Warning System (Erdik et al. 2003). A comparison of the different correlation models is provided in Fig. 6.4 (Wagener et al. 2016). As it can be assessed, a large variability in the correlation lengths (1.65–43.5 km) exist. Correlation models based on Japanese and Taiwanese data generally exhibit a more gradual decay with distance and longer correlation lengths compared to Marmara and the California models. The period dependence of the PSA correlation coefficient (more gradual decay with distance for longer periods) was observed by Goda and Hong (2008a, b) in California as well as by Goda and Atkinson (2010) in Japan.

Comparison of different correlation models reported in the literature (Wagener et al. 2016)

For conducting spatially correlated simulations of ground motion, two of the utilized formulations are the covariance and spectral formulations (Wu and Baker 2014). In Covariance Formulation, the intra-event residual term, εij, can be constructed through sampling from a multivariate normal distribution with a {0} mean vector and covariance matrix, Σxy, defined by Eq. 6.21 (Wu and Baker 2014).

where, Σxy is the covariance matrix between sites x and y, stored as the (xth, yth) element of the n × n (n is number of sites/cells) covariance matrix Σ. Covariance formulation has a significant computational expense and can only be used for a modest number of sites.

3.3 Correlation Between IMs at the Same Site

If different IMs are needed for different fragility or vulnerability functions (especially for heterogeneous assets) these IMs need to be cross-correlated. The cross-correlation between the residuals of spectral accelerations (the difference between SA(T1) and SA(T2) based on a GMPM) feature a correlation that depends on the inter-period difference (Baker and Cornell 2006). Several models have been proposed for correlation of pseudo-spectral accelerations recorded at the same site (Inoue and Cornell 1990; Baker and Cornell 2006; Baker and Jayaram 2008). Plots of the correlation coefficients based on the predictive equation provided in Baker and Jayaram (2008) are given in Fig. 6.5.

Plots of correlation coefficients (Baker and Jayaram, 2008). a Plots of correlation coefficients versus T1, for several T2 values; b contours of correlation coefficients versus T1 and T2

Weatherill et al. (2013) provides a comprehensive description of the generation random fields of ground shaking considering the inter-period correlation of the ground motion residuals.

4 Probabilistic Seismic Hazard Assessment (PSHA)

PSHA is an essential part of Probabilistic Seismic Risk Analysis (PSRA) in the Performance-Based Earthquake Engineering (PBEE) framework (McGuire 2004; Goulet et al. 2007; Ruiz-Garcia and Miranda 2007). Hazard Curves provide the probabilities of exceedance in a given time period for given values of an IM. Probabilistic Seismic Hazard Assessment (PSHA) is used to obtain the annual rate of exceeding the ground motion intensity measure, λ(IM). PSHA is traditionally represented by following the total probability theorem (Cornell 1968; McGuire 2004):

where: λ(M > mmin) is the annual rate of earthquakes with magnitude greater than or equal to the minimum magnitude mmin, r is the source distance, m is the earthquake magnitude and; fM(m) and fR(r) are the probability density functions (PDFs) for the magnitude and distance. It should be noted that: this equation is indicated for a single earthquake source zone and the integration is over all considered magnitudes and distances. The integration process can be extended to encompass other earthquake sources as well.

4.1 Monte Carlo Simulation

Monte-Carlo method can be utilized to estimate the probabilistic seismic hazard, instead of the computation through the total probability integral given by Eq. 6.22. The same also holds for probabilistic seismic risk applications through the total probability integral given by Eq. 6.5. As such, for seismic hazard and risk assessment applications, it is rational to carry out a numerical evaluation of the probabilistic earthquake risk using a Monte Carlo simulation-based approach.

Monte Carlo method is based on a multitudinous resampling of an earthquake catalog to construct synthetic earthquake catalogs and then to find earthquake ground motions from which the hazard values are found (Ebel and Kafka 1999). For PSHA assessment first element of the Monte Carlo simulation technique is to generate synthetic earthquake catalogs (Stochastic Event Sets) for each source zone by drawing random samples from the assumed PSHA model components (Musson 2000; Scherbaum et al. 2004). Subsequently, the ground motion intensity-measures (IMs) can be evaluated for each earthquake contained in the catalog and, for all earthquakes in the catalog, a history of ground motion IM estimates is obtained at each site. These estimates are reorganized to develop a list of the annual maximum IMs in ascending order, to yield the seismic hazard curve through a plot of the sorted annual maximum IMs as a function of the probability of exceedance.

4.2 Ground Motion Distribution Maps

Ground-motion IM Field Maps describes the geographic distribution of a given IM obtained considering an earthquake rupture and a GMPM. The spatial correlation of the intra-event residuals can be considered in the generation of the field.

The earthquake shaking can be determined theoretically for assumed (scenario) earthquake source parameters through median ground motion prediction models or, for post-earthquake cases, using a hybrid methodology that corrects the analytical data with empirical observations. These type of maps are generally called as “ShakeMaps” (Wald et al. 2006, https://earthquake.usgs.gov/data/shakemap/). In insurance industry, post-earthquake ShakeMaps are used with industry exposure data to calculate insured loss estimates (Parametric Earthquake Insurance).

For the analysis of seismic risk (especially for distributed assets), it is necessary to produce a spatially correlated field of ground motion. The ground motion IM across a region should be defined in a manner that is consistent with either a given earthquake scenario or a given return period. Pitilakis et al. (2014b) refers to these maps as a “Shakefield”.

4.3 Risk-Based Earthquake Hazard: Risk-Targeted Hazard Maps for Earthquake Resistant Design

The earthquake resistant design of structures requires the definition of design basis ground motion for a given return period, with the assumption that the probability of collapse for buildings is uniform regardless of the location. However, for a rigorous and explicitly uniform probability of collapse, the hazard maps should essentially be risk-based. In ASCE-SEI codes, risk target is taken as 1% probability of collapse in 50 years).

The distribution of the collapse capacity in terms of a specific IM can be defined by a cumulative lognormal function with log mean, β, and log standard deviation, β. Luco et al. (2007), using a β = 0.8, found a probability of collapse of 10% at 2475-year ground motion level in the USA. Douglas et al. (2013), using a β = 0.5, found a probability of collapse of 10–5 at the 475-year return period design ground motion level, for new buildings in France.

5 Assets Exposed to Earthquake Hazard, Building Inventories

Assets Exposed to Hazard is represented by the Exposure Model that contains the information regarding the assets (such as building inventories) within the area of interest for the assessment of earthquake risk.

To perform a seismic risk assessment, building inventories are determined based on specific classification systems (taxonomies).

Building taxonomies define structure categories by various combinations of use, time of construction, construction material, lateral force-resisting system, height, applicable building code, and quality (FEMA 2003; EMS-98-Grunthal 1998 and RISK-UE 2004).

Publicly available data, at country and regional spatial scale, includes: UN-Housing database, UN-HABITAT, UN Statistical Database on Global Housing, Population and Housing Censuses of individual Countries (https://en.wikipedia.org/wiki/Population_and_housing_censuses_by_country), the World Housing Encyclopedia (WHE) database developed by EERI and IAEE (http://www.world-housing.net).

The “Global Exposure Database for the Global Earthquake Model” project, under the Global Earthquake Model (GEM—www.globalquakemodel.org) framework, is concerned with the compilation of an inventory of assets at risk (Gamba et al. 2014 and Dell’Acqua et al. 2012). The USGS—Prompt Assessment of Global Earthquakes for Response (PAGER) (Wald et al. 2010) undertaking has also developed a comprehensive global inventory of assets exposed to earthquake hazard (Jaiswal et al. 2010).

6 Fragility, Consequence and Vulnerability Relationships

Fragility Relationships (Models) describe the probability of exceeding a set of damage states, given an intensity measure level. HAZUS (FEMA 1999) uses four damage states as the: slight, moderate, extensive and complete damage. Combining the fragility information with consequence (damage to loss) functions, which describe the probability distribution of loss given a performance (damage) level, allows for the derivation of vulnerability functions. Vulnerability functions can be used to directly estimate economic losses, where the loss ratio could be the ratio of cost of repair to the cost of replacement for a given building typology.

The seismic fragility and vulnerability functions are customarily modeled by lognormal cumulative distribution functions (CDF) (Ellingwood 2001; Wen et al. 2004). The fragility function is the conditional probability of reaching or exceeding a specific value of the Damage State (DS >= ds) or a Damage Index (DI) reaching or exceeding a specific value of Limit State (LS) (DI => LS), for a given Intensity Measure (IM). On the other hand, the vulnerability function is represented by the conditional probability of reaching or exceeding a specific value of the loss (Loss >= loss) for a given Intensity Measure (IM), such as Spectral Displacement (Sd). By assuming a lognormal distribution of EDP at a given IM, the fragility function, defined as the damage index (DI) compared with the limit states (LS), corresponding to various damage states (SD) for given intensity measure (IM), can be written as:

where, σEDP|IM is the standard deviation of the logarithmic EDP distribution given by EDP = a (IM)b or ln(EDP) = ln a + b ln(IM), (a and be are regression coefficients resulting from the response data) and; Φ(•) is the standard normal distribution function.

In more colloquial terms: the fragility function, which determines the probability that a building or a group of buildings will be in, or exceed, the ith damage state, di, for a given level of ground motion intensity (IM), is commonly expressed conditionally in the form of a cumulative lognormal distribution.

where P is the exceedance probability for the ith damage state, IM is the ground motion intensity, Φ is the standard normal cumulative distribution function, βdi is the standard deviation of the natural logarithm (dispersion) of ground motion intensity for the ith damage state and IMdi is the median value of ground motion intensity at which the subject reaches the ith damage state. Typical fragility and vulnerability functions are illustrated in Fig. 6.6, after Luco and Karaca (2006).

Typical fragility and vulnerability functions (Luco and Karaca 2006)

Numerous approaches exist towards “direct” estimation of fragility and vulnerability functıons at various levels of resolution. Approaches that are generally used for the “direct” estimation fragility and vulnerability functıons are empirical, analytical and hybrid.

Empirical fragility and vulnerability relationships based on the use of macroseismic intensity (MMI, EMS’98) and the observed damage/loss data is still a valuable choice for fragility and vulnerability modeling. An empirical vulnerability function for Turkish building stock is provided in Fig. 6.7 to provide an example. Using the EMS’98 (Grunthal 1998) intensity definitions, Giovinazzi and Lagomarsino (2004) developed a method on the basis of beta damage distribution and fuzzy set theory to produce fragility matrices. This method has been incorporated into the ELER earthquake loss assessment tool.

Analytical (or predicted) fragility refers to the assessment of the expected performance of buildings based on calculation and building characteristics. The capacity spectrum method, originally derived by Freeman (1998), is first implemented within the HAZUS (FEMA 2003) procedure as well as in many other earthquake loss estimation analyses (e.g. SELENA—Molina and Lindholm, 2010 and ELER (Erdik et al. 2008; Hancılar et al. 2010). DBELA (Displacement-Based Earthquake Loss Assessment) method (Crowley et al. 2004; Bal et al. 2008) relies on the principles of direct displacement-based design method of Priestley (2003).

Vulnerability functions can also be derived “‘indirectly” through the combination of a fragility function and a damage-to-loss or consequence models. Consequence models provide the values of “Mean Damage Ratio (MDR)’’, defined as the cost of repairing the structure (to bring it to its pre-earthquake state) divided by its replacement cost, for each damage state. A typical table is provided in Table 6.1 for EMS’98 damage grades (Yepes-Estrada et al. 2014).

Several compilations of literature-based fragility and vulnerability functions exist. Such as: GEM database of vulnerability and fragility functions for buildings (Yepes-Estrada et al. 2016; Yepes-Estrada et al. 2014) and SYNER-G database for infrastructure fragilities (Pitilakis et al. 2014b; Crowley et al. 2014).

Correlation of Vulnerability/Fragility Uncertainties

In general, fragility and vulnerability function correlations are incorporated only for limit cases of independent or perfectly correlated component damage states and, it is generally not possible to do more than an estimate the losses, with and without vulnerability uncertainty correlation, to constrain the results. Evidence of correlation of vulnerability and fragility function uncertainties can be obtained from post-earthquake damage surveys.

7 Metrics Used in Risk Assessment and CAT Modeling

For the measurement of risk for a single asset or portfolio of assets, several metrics, in physical and financial loss terms, are used. Following is a brief explanation of these metrics.

The Loss Exceedance (or Exceedance Probability, EP) curves, the Average Annual Loss (AAL) and Probable Maximum Loss (PML) constitute the primary metrics of the probabilistic risk/loss assessment. In engineering terms, the losses associated with the building stock are generally quantified in terms of Los Ratio (LR), defined as the repair cost divided by the replacement cost. LR is also called as the damage factor, damage ratio and fractional loss.

Loss Exceedance Curves (EP Curves) describe losses versus probability of exceedance in a given time span (generally, annual). EP Curves are used for cat modelling, as it is beneficial to identify attachment or exhaustion probabilities, calculate expected losses within a given range, or to provide benchmarks for comparisons between risks or over time.

Occurrence Exceedance Probability (OEP) is the probability that the associated loss level will be exceeded by any event in any given year. It provides information on losses assuming a single event occurrence in a given year. Aggregate Exceedance Probability (AEP) is the probability that the associated loss level will be exceeded by the aggregated losses in any given year. It provides information on losses assuming one or more occurrences in a year.

The AEP and OEP can be used for managing exposure both to single large event and to multiple events across a time period. They can be similar when the probability of two or more events is very small; they are identical when there is zero probability of two or more events. However, AEP can be very different from the OEP when the probability of two or more events is significant.

Value at Risk (VaR) is equivalent to the Return Period, and measures a single point of a range of potential outcomes corresponding to a given confidence. The VaR is the fractile value on an EP curve corresponding to a selected probability level.

Tail Value at Risk (TVaR) measures the mean loss of all potential outcomes with losses greater than a fixed point. When used to compare two risks, along with mean loss and Value at Risk, it helps communicate how quickly potential losses tail off.

VaR and TVaR are both mathematical measures used in cat modelling to represent a risk profile, or range of potential outcomes, in a single value.

Conditional Value at Risk (CVaR) is the area under the EP curve below a selected cumulative probability level, p, normalized by the probability of exceedance (1 − p). CVaR, accounts for the rare events in terms of their severity and frequency by taking the conditional expectation of the EP curve.

Average Annual Loss (AAL) (or Annual Estimated Loss—AEL or Pure Premium) is the expected value of a loss exceedance distribution and can be computed as the product of the loss for a given event with the probability of at least one occurrence of event, summed over all events. AAL is the average loss of all modeled events, weighted by their probability of annual occurrence (EP curve) and corresponds to the area underneath the EP curve. If the loss ratio (LR) is used for the quantification of loss, then the term Average Annual Loss Ratio (AALR) is used in lieu of AAL. For earthquake insurance purposes, the AAL or AALR is of particular importance in determining the annual pure premiums.

Pure Premium represents the average of all potential outcomes considered in the analysis, and could be considered to be the break-even point if such a policy is to be written for very large number of times.

The Probable Maximum Loss (PML) is one of the most popular metrics in financial risk management, and there are several definitions. PML can be associated with the OEP or the AEP. Conventionally, PML was defined as a fractal of the loss corresponding to the return period of 475 years. In Japan, the PML is defined as the (conditional) 0.9-fractile value for a scenario that corresponds to a selected probability level (typically, return period of 475 years).

ASTM E2026-16A use specific nomenclatures for seismic risk assessment of buildings. are in use:

Scenario Upper Loss, based on deterministic analysis) (SUL) is defined as the earthquake loss to the building with a 90% confidence of non-exceedance (or a 10% probability of exceedance), resulting from a specified event on specific faults affecting the building. If the specified earthquake hazard is the 475-year return period event, then this term can be called the SUL475, and this term is the same measurement as the traditional PML defined above.

Scenario Expected Loss, based on deterministic analysis, (SEL) is defined as the average expected loss to the building, resulting from a specified event on specific faults affecting the building. If the specified earthquake is the 475-year return period event, then this term can be called the SEL475.

The Probable Loss, based on probabilistic analysis, (PL) is defined as the earthquake loss to the building(s) that has a specified probability of being exceeded in a given time period from earthquake shaking. The PL is commonly taken as the loss that has a 10% probability of exceedance in 50 years, which is called the PL475, because it corresponds to a return period of 475 years.

8 Earthquake Risk Assessment Models and Example Applications

The estimation of the earthquake risk due to deterministic earthquake scenarios is of use for communicating seismic risk to the public and to decision makers. However, a probabilistic assessment of earthquake risk (generally called, Probabilistic Seismic Risk Analysis-PSRA) is needed for risk prioritization, risk mitigation actions and for decision-making in the insurance and reinsurance sectors.

Seismic risk for a single element at risk can be calculated through the convolution of a hazard curve with a vulnerability relationship quantifying the probability of a given consequence occurring under different levels of ground shaking. For geographically distributed elements, the use of hazard curves calculated with conventional PSHA, may overestimate the total loss since the conventional PSHA does not distinguish the inter- and intra-earthquake variability of ground motion (Crowley and Bommer 2006).

Since the PSRA encompasses multitude sources of uncertainties stemming from hazard, inventory and vulnerability (or fragility and consequence) functions, Monte Carlo simulations are routinely employed to facilitate the orderly propagation of these uncertainties within the process. Using Monte Carlo simulations, a value of the inter-earthquake variability can be sampled for each earthquake and then values of the intra-earthquake variability are sampled at each location for this earthquake. Such event-based simulation involves suites of probabilistically characterized deterministic risk scenarios (e.g. Crowley and Bommer 2006; Silva et al. 2013).

Similar to PSHA, the results of a PSRA can also be deaggregated to identify the components of the overall system (i.e. earthquake scenarios) that are contributing significantly to the seismic risk (e.g. Goda and Hong 2008a, b; Jayaram and Baker 2009).

One of the first rational assessment of earthquake risk is carried out by Whitman et al. (1973) using MMI versus Damage Ratio matrices. Similar studies in USA led to the development of HAZUS (FEMA 2003) Some of the open access and state-of-the-art software packages for earthquake risk assessment can be listed as follows:

-

CAPRA GIS-Earthquake module, http://www.ecapra.org/software

-

EQRM, http://www.ga.gov.au/scienti.ic-topics/hazards/earthquake/capabilties/modelling/eqrm

-

ERGO (MAEviz/mHARP), http://ergo.ncsa.illinois.edu/?page id = 48

-

HAZUS-MH earthquake module, http://www.fema.gov/hazus

-

OpenQuake, https://www.globalquakemodel.org/openquake/

-

ELER,http://www.koeri.boun.edu.tr/Haberler/NERIES%20ELER%20V3.16 176.depmuh

-

RiskScape-Earthquake, https://riskscape.niwa.co.nz/

-

SELENA, http://www.norsar.no/seismology/engineering/SELENA-RISe/

The OpenQuake Engine (https://www.globalquakemodel.org/) is GEM ‘s state-of-the-art software for seismic hazard and risk assessment at varying scales of resolution, from global to local. It is open-source, fully transparent and can be used with GEM or user-developed models to carry out scenario-based and probabilistic hazard and risk calculations and produce a great variety of hazard and loss outputs. Spatial correlation of the ground motion residuals and correlation of the uncertainty in the vulnerability can be modeled. Main calculations performed in connection with the earthquake loss assessment can be listed as: Scenario risk; Scenario damage; Classical PSHA-based risk; Probabilistic event-based risk and; Retrofitting benefit-cost ratio. Comprehensive global earthquake risk maps were provided by GEM (https://www.globalquakemodel.org/gem).

Today, the seismic risk/loss assessment can be essentially grouped under the following three approaches (Silva et al. 2013):

-

Deterministic Risk/Loss Calculation (analysis due to a single earthquake scenario);

-

Probabilistic Risk/Loss Calculation (an analysis that considers a probabilistic description of the earthquake events and associated ground motions) and;

-

Classical PSHA-Based Risk/Loss Calculation (analysis based on conventional probabilistic earthquake hazard assessment).

8.1 Deterministic Earthquake Risk/Loss Calculation

In this approach, the earthquake loss is computed due to a single, deterministic earthquake scenario. The flowchart of the process is shown in Fig. 6.8. The hazard input consists of a scenario earthquake source parameters and a single (or a set of) GMPMs. By repeating the same deterministic loss assessment process, and sampling the inter- and intra-variability (spatial variability) from the GMPM each time, many ground motion fields can be computed to account for the aleatory variability in the ground motion. The losses to all assets (with different typologies and vulnerabilities) in the region of interest can be aggregated per ground motion field, for statistical studies of aggregated losses.

Following are some earthquake risk assessment examples, where, deterministic earthquake loss calculation procedure is used.

8.1.1 Deterministic Loss Assessment for Buildings in a Region in Istanbul

In recent studies (i.e. Bohnhoff et al. 2013; Ergintav et al. 2014) the Princess Islands Segment of the Main Marmara Fault (Fig. 6.9) has been identified as the “most imminent danger” to Istanbul. This fault segment has been considered (Type: Strike-Slip; Magnitude: Mw7.3, Recurrence Model: Fully Characteristic; Slip Rate: 20 mm/year, Dip: 90°, Rake: 0°) with the Kale et al. (2015) GMPM and spatial correlation models of Wagener et al. (2016) and Goda and Hong (2008a) to compute 1000 simulations of earthquake ground motion distribution and then the loss in the most densely populated region of Istanbul.

Princess Islands Segment of the Main Marmara Fault (Bohnhoff et al. 2013)

Figures 6.10 and 6.11 illustrate the median and 84-percentile PGA and PGV shake fields after 1000 simulations of ground motion based on Kale et al. (2015) GMPM and Wagener et al. (2016) correlation models.

For loss assessment the intensity-based fragility relationships of Lagomarsino and Giovinazzi (2006) are considered. Instrumental intensities were computed from PGA and PGA-conditioned PGV distributions using the Wald et al. (1999) relationships. Figure 6.12 provides the median and 84-percentile loss ratios (for mid-rise, post-2000 R/C buildings) for cases of full and no spatial correlation of intra-event residuals and for the cases of Wagener et al. (2016) and Goda and Hong (2008a, b) relationships-based spatial correlations. The same spatial correlation cases were also used in Fig. 6.13, where the total economic loss curve (Exceedance Probability-EP Curve) due to structural damage is illustrated in Fig. 6.13. As it can be assessed: for high probabilities (low loss) spatial correlation results are above full correlation results (similar to no correlation results) and; for low probabilities (high loss) spatial correlation results are located between the full correlation and no correlation results. Full correlation and no correlation cases overlap each other because of the intra-event residuals are zero mean normal distributions and these marginal cases would yield the same results since under any mathematical operation (linear or nonlinear) realized for a zero-mean normal variable will yield a zero mean variable. Figure 6.12 provide distributions of the loss ratio in the geographic region considered corresponding to median and median + sigma intensity distributions. Figure 6.13 approaches the same problem probabilistically and provides the likelihood of experiencing different total economic loss values in the region considered by taking into account the annual occurrence frequency of each of the 1000 events simulated.

8.1.2 Deterministic Earthquake Loss Assessment in the Zeytinburnu District of Istanbul

Wagener et al. (2016) has computed the losses in the Zeytinburnu district of Istanbul that would result from an Mw7.2 scenario earthquake on the Marmara Fault. The building portfolio consisted of 11,250 reinforced concrete and masonry buildings. PGA, SA(0.3 s) and SA(1 s) distributions were calculated considering various spatial correlation models as well as their cross-correlations. The GMPM relationship of Akkar and Bommer (2010) was considered. Figure 6.14 illustrate the effects of the different correlation models on the spatial distribution of PGA. The loss histograms are shown in Fig. 6.15 with the distribution parameters, mean μ, median m, standard deviation σ, and skewness S. As it can be seen, while the mean loss remains essentially unaltered, the coefficient of variation increases with increasing correlation from 0.102 to 0.411. From Fig. 6.15, it can be assessed that the uncorrelated ground motion (a) results in a narrow, bell-shaped loss distribution with a mean of 1.62 billion € and a coefficient of variation (CV) of 0.108. When correlation models are implemented (b, c), the mean loss remains unaltered but the shape of the loss distribution changes significantly. The coefficient of variation increases and the loss distribution is skewed towards higher losses. The included spatial correlation increases the likelihood of simultaneous large ground motions in many geocells, as illustrated in the realizations of simulated PGA-distributions in Fig. 6.14. Consequently, the likelihood of damage to many buildings increases. If the correlation lengths increase with the spectral period, mid- and high-rise buildings will be more affected by correlation properties than low-rise buildings, since higher variability in the loss distributions, were observed when increasing the correlation length.

Realizations of simulated PGA-distribution in Zeytinburnu with various correlation properties. a No spatial correlation, b Wagener et al. (2016) correlation model c a simple one-parameter exponential decay with 20 km correlation length

Histograms of aggregated economic loss in Zeytinburnu with various correlation properties. a No spatial correlation, b Wagener et al. (2016) correlation model c a simple one-parameter exponential decay with 20 km correlation length

Deterministic Earthquake Risk Assessments for İstanbul

Silva et al. (2012) provides an application of Openquake software-based deterministic loss calculation to develop a mean loss (USD) distribution map for İstanbul as shown in Fig. 6.16. The application considers a deterministic Mw7.5 magnitude earthquake on the Main Marmara Fault. Only reinforced concrete buildings are considered, which constitutes about 80% of the building inventory (Erdik 2010). Boore and Atkinson (2008) GMPM was used to produce about 500 ground motion fields, where the intra-event variability was sampled by the model proposed by Jayaram and Baker (2009).

Distribution of mean economic losses in Istanbul (Silva et al. 2012)

A comprehensive earthquake risk assessment study was conducted by Boğaziçi University, OYO International and GRM Ltd. for İstanbul Metropolitan Municipality (İBB) in 2009 (http://istanbul-olasi-deprem-kayiplari-tahminlerinin-guncellenmesil_sonuc_rapor_2010.09.pdf). This study was updated in 2018 by Boğaziçi University for the İBB (http://depremzemin.ibb.istanbul/wp-content/uploads/2020/02/dezim_kandilli_deprem-hasar-tahmin_raporu.pdf). The 2009 study was based on a single scenario earthquake (Mw7.5), rupturing the Main Marmara Fault to simulate the so-called pending “İstanbul Earthquake” with an annual probability of occurrence of about 2–3%. Intensity- and spectral acceleration-based fragilities were considered. Loss ratios for the buildings, as well as other losses, were determined for median and 84-percentile probabilities. In addition to this Mw7.5 scenario earthquake, the 2018 study also considered single stochastic ground motion simulations for several rupture alternatives and the official PSHA map for different return periods, for the earthquake ground motion. The aggregate building damage results for different damage states, obtained from different rupture scenarios, do not differ much from the results of the Mw7.5 scenario earthquake. The risk in both studies was computed using a classical simple deterministic approach, with no consideration of spatial variation of ground motion intensity.

The building damage rates that would result from the occurrence of the Mw 7.5 Istanbul earthquake scenario indicate that the medıan damage ratios for buildings with no, light, medium, heavy and very heavy/collapse damage status are respectively found to be about 60, 26,11, 2 and 1%. Noting that as of 2020 there are about 1.1 million buildings and 3.9 million housing units in the İstanbul Province, one can estimate that about 0.44 million buildings (about 1.6 million housıng units) will receive some degree of damage after exposure to the “İstanbul Earthquake”. In monetary terms, this structural damage will correspond to about USD 6.5 billion.

On the basis of the 2009 Boğaziçi Uninersity risk assessment study, Hancılar et al. (2010) provides for the distribution of the rates of medium building damage in İstanbul (Fig. 6.17) in terms of the number of damaged buildings per geographic cell. Distribution of building structural loss ratio is provided in Fig. 6.18, using the site-specific median ground motion for a deterministic scenario earthquake of Mw7.5 on the Main Marmara Fault.

Rates of building damage in İstanbul for medium damage grade (Median ground motion from deterministic scenario earthquake of Mw7.5 on the Main Marmara Fault) (Hancılar et al. 2010)

8.2 Probabilistic Earthquake Risk Calculation

In the Probabilistic Loss Calculation process the probability of losses and loss statistics are computed using Monte-Carlo simulations, based on stochastic event sets and associated ground motion fields Goda and Yoshikawa (2012). The flowchart of the process is shown in Fig. 6.19. For the realistic calculation of the ground motion field for each event, the sampling of the inter-event variability and the spatial correlation of the intra-event residuals of the ground-motion model should be considered. The set of ground-motion fields are combined with the exposure and vulnerability model to obtain losses. In this combination, the correlation of the uncertainty in the vulnerability model may also be incorporated. For the computation of the loss exceedance curve: the cumulative histogram, built using the list of losses per asset (of a given typology) in selected bins of loss over the time span, can be considered. An aggregated loss curve, representative of the whole set of assets within the region (or portfolio) can be obtained by aggregating all the losses.

Following are some earthquake risk assessment examples, where, probabilistic earthquake loss calculation procedure is used.

Probabilistic Earthquake Risk Assessments for İstanbul

Using GEM OpenQuake Probabilistic Loss Calculation process, Crowley et al. (2011) present (respectively in Fig. 6.20a and b) a loss map and a total loss exceedance curve for a probability of exceedance of 10% in 50 years for reinforced concrete buildings located in the metropolitan area of Istanbul.

a and b Loss map and loss exceedance curve for a probability of exceedance of 10% in 50 years for RC buildings located in metropolitan Istanbul (Crowley et al. 2011)

Akkar et al. (2016) have computed the earthquake losses in central Istanbul using the probabilistic loss calculation process. The earthquake risk was assessed using intensity-based fragility relationships of Lagomarsino and Giovinazzi (2006), where the instrumental intensities were computed using the Akkar and Boomer (2010) and Akkar et al. (2014)-based PGA and PGV values. Figure 6.21a and b show probability exceedance of very heavy damage state (DS4 in EMS’98) in 50 years for post-2002 low-rise RC buildings.

Turkish Catastrophe Insurance Pool (TCIP) Loss Modeling

In 2018 TCIP has engaged Turkish Earthquake Foundation (TDV) to carry out an estimation of earthquake losses to its insured portfolio losses for reinsurance purposes. A comprehensive investigation encompassing a review of existing building census, building types, soil conditions, near-fault effects, spatial distribution of ground motion, fragility relationships and consequence functions was conducted. Two types of loss calculation procedures are considered: (A) Monte Carlo process based SHA considering all of the seismic sources in the region 5000 × 100-year catalogs generated and (B) Monte Carlo process based SHA considering only the selected segments of the Main Marmara Fault (i.e. North Anatolian Fault) that are believed to be primed for rupture for an annual probability of about 2–3% (Fig. 6.22). On these segments 2000 deterministic earthquake scenario models of magnitude between Mw6.8–7.4 and hypcentral depths between 0 and 18 km (simulating the so-called pending Istanbul Earthquake) are generated.

To provide some examples of the results, the loss of the TCIP portfolio insured value (Procedure—A) for the Istanbul Province (EP Curve) is provided in Fig. 6.23. The vertical axes of this EP curve show annual probability of exceedance and also the average return period. The loss of the TCIP insured value for 100- and 200-year average return periods are approximately 3 and 5 Billion USD, respectively.

Figure 6.24 shows the loss of the TCIP portfolio insured value (Procedure—B) for the Istanbul Province (EP Curve). The vertical axis of this EP curve shows the probability of exceedance, since the deterministic earthquake scenarios considered in the analysis refer to different models of the same (the pending Istanbul Earthquake) event. The loss of the TCIP portfolio insured value is about USD 3 Billion USD (median) with a standard deviation of USD 2 Billion. The median ratio of buildings that will receive no, light, medium, heavy and very heavy/collapse damage status are respectively found to be about 40%, 41%, 10%, 8% and 1%. Noting that as of 2020 the number of TCIP policies in İstanbul Province is about 2.5 million, one can expect, on the average, about 1.5 million claims only from the İstanbul Province, in the event of the “İstanbul Earthquake”.

8.3 Classical PSHA-Based Earthquake Risk Calculation

In this approach, classical PSHA assessment (Cornell 1968; McGuire 2004) can be used to calculate loss exceedance curves for single assets, calculated site by site, on the basis of hazard curves. The flowchart of the process is shown in Fig. 6.25. Discrete vulnerability functions are converted into a loss exceedance matrix (e.g. a matrix which describes the probability of exceedance of each monetary loss value or loss ratio for a discrete set of intensity measure levels). The values of each column of this matrix are multiplied by the probability of occurrence of the associated intensity measure level, extracted from the hazard curves. To compute the loss exceedance curve: the probabilities of exceedance of the loss (or the loss ratio) curve are obtained by summing all the values per loss (or loss ratio).

Demircioğlu et al. has computed the grid-based building damage distributions, loss ratios (LR) and average annual loss ratios (AALR) corresponding to 72, 475, and 2475-year average return periods. Figure 6.26 provides sub-province based LR values for Turkey for the 475-year average return period. Figure 6.27 provides geo-cell based LR values for the Marmara Region for the 475-year average return period at geo-cell (0.05o × 0.05o) resolution.

A classical PSHA-based earthquake loss assessment for California have been carried out using HAZUS (FEMA 2003) to estimate county-based Annual Economic Loss and Annual Average Loss Ratios (Fig. 6.28, Chen et al. 2016). Similar studies have also been conducted for Turkey using ELER for the assessment of sub-district based AAL values (Fig. 6.29).

County-based annual economic loss and annual average loss ratios for California (Chen et al. 2016)

Studies of the Global Earthquake Model (GEM) initiative have culminated in 2018 in the development of global earthquake risk maps (https://www.globalquakemodel.org/gem). Figures 6.30 and 6.31 provides respectively the AALR maps and the EP curve for the USA and Turkey. In these figures the average annual loss ratio represents the long-term mean average annual loss normalized by the total asset replacement cost within the subdivision due to direct damage caused by earthquake ground shaking in the residential, commercial and industrial building stock, considering structural and non-structural components and building contents.

AALR distribution and EP curve for the USA (https://www.globalquakemodel.org/gem)

AALR distribution and EP curve for Turkey (https://www.globalquakemodel.org/gem)

Turkish Catastrophe Insurance Pool (TCIP) AALR Models

In 2018 TCIP has engaged Turkish Earthquake Foundation (TDV) to carry out a risk based update of its insurance pricing in consideration of the newly prepared national earthquake hazard map and the prevailing building typology. A comprehensive investigation encompassing a review of existing building census, building typology, fragility relationships and consequence functions was conducted. To provide some examples of the results. the AALR distribution map for all buildings on sub-district basis is provided in Fig. 6.32 and the geo-cell (0.05° × 0.05°) based distribution of AALR for post 1979, low rise reinforced concrete frame buildings in the Marmara Region of Turkey is shown in Fig. 6.33.

8.4 Effect of the Spatial Correlation of Ground Motion on Earthquake Loss Assessments

The effect of the consideration of spatial correlation of IMs, can be assessed from the examples provided for both deterministic and probabilistic earthquake loss applications: Sect. 6.8.1.1 Deterministic Loss Assessment for Buildings in a Region in Istanbul and Sect. 6.8.1.2 Deterministic Earthquake Loss Assessment in the Zeytinburnu District of Istanbul. The findings in these sections essentially follow those obtained by Park et al. (2007) who has performed stochastic simulation of ground motion fields to compute seismic losses within two portfolios of structures. Annual Mean Rate of Exceedance (essentially, EP) curves, for building portfolios with large and small footprints are assessed for six different models for the correlation coefficient, varying from no correlation at all distances to fully correlated ground motion fields, to study their effect on the EP curves. Park et al. (2007) has observed that: for either portfolio type, no correlation related losses associated with low probabilities of exceedance are significantly underestimated compared to the cases with correlation. The relative underestimation of losses associated with low probabilities of exceedance are evident for portfolios with small footprint than that with the large footprint and the effect of spatial correlation on the entire portfolio was found to be larger if the correlation length is comparable or larger than the footprint of the portfolio.

9 Uncertainties in Risk Assessments

The main sources of uncertainties in earthquake risk assessment are:

-

Hazard uncertainty (seismic source characterization and ground motion modeling)

-

Vulnerability uncertainty

-

Uncertainty in the assumptions and specifications of the risk model

-

Portfolio uncertainty (location and other attributes of the building classes).

In general, there exist two types of uncertainties that need to be considered in earthquake risk/loss assessments: aleatory and epistemic. Aleatory uncertainty accounts for the randomness of the data used in the analysis and the epistemic uncertainty accounts for lack of knowledge in the model.

Aleatory variability, that generally affects the loss distributions and exceedance curves is directly included in the probabilistic analysis calculations through the inclusion of the standard deviation of a GMPM considered in the analysis. Epistemic uncertainties, which can increase the spread of the loss distributions, are generally considered by means of a logic tree formulation with appropriate branches and weights associated with different hypotheses. Similarly, Monte-Carlo techniques can also be used to examine the effect of the epistemic uncertainties in loss estimates.

Demand Surge and Loss Amplification represent the so-called Post Event Inflation elements in earthquake risk assessment. They arise due to: Shortages of labor and materials, which cause prices to rise; Supply/demand imbalances delay repairs, which results in structural deterioration and; Political issues (due to the size of the disaster and under pressure from politicians, insurers are encouraged to settle claims generously).

Figure 6.34 (after Wong et al. 2000) illustrates the effect of uncertainties on loss estimation. Uncertainties arise in part from incomplete inventories of the built environment, inadequate scientific knowledge of the process, earthquake ground motion (IMs) and their effects upon buildings and facilities (fragility/vulnerability relationships). The reliability of the fragility/vulnerability relationships is essentially related to the conformity of the ground motion IMs with the earthquake performance (damage) of the building inventory. These uncertainties can result in a range of uncertainty in loss estimates, at best, a factor of two.

Effect of Uncertainties on Loss Estimation (Wong et al. 2000)

The general finding of the studies on the uncertainties in earthquake loss estimation is that the uncertainties are large and at least as equal to uncertainties in hazard analyses (Stafford et al. 2007; Strasser et al. 2008). It should also be noted that the estimates of human casualties are derived by uncertain relationships from already uncertain building loss estimates, so the uncertainties in these estimates are rather compounded (Coburn and Spence 2002).

Financial loss caused by the earthquakes is, essentially, the translation of physical damage into total monetary loss using local estimates of repair and reconstruction costs. Several regression-based simplified equations are developed to calculate earthquake losses. The failure of such simple procedures that stem from the extensive uncertainties in the physical process are exemplified in Fig. 6.35 (after Daniell 2014) where a comparison between the observed and calculated financial losses caused by earthquakes are shown. As it can be seen, the inherent uncertainties in the loss calculations can cause differences up to two orders of magnitude between the observed and calculated financial losses.

Observed versus calculated costs for 4 different studies (After Daniell 2014)

To show the effect of these uncertainties on the AALR distributions, Fig. 6.36 provides a comparison of sub-district based AALR distribution in Turkey, prepared by TCIP and by different vendor Cat-Models, Although the AALR values of the vendor models are not shown, the colors from red, pink, yellow, light green to dark green indicate decreasing values of AALR. The difference in the distribution of these colors between the four models is significant and evidences the effect of data and modeling uncertainties. Another evidence of these uncertainties is illustrated in Fig. 6.37, where a comparison of Exceedance Probability (EP) curves for Istanbul by different vendor Cat-Models are provided. As it can be observed differences up to 100% exist. These EP curves cannot be directly compared with Fig. 6.23 due to the much smaller (about one-half) TCIP portfolio used in their computation.

10 Conclusions

-

Earthquake risk and loss assessment is needed to prioritize risk mitigation actions, emergency planning, and management of related financial commitments. Insurance sector have to conduct the earthquake risk analysis of their portfolio to assess their solvency in the next major disaster, to price insurance and to buy re-insurance cover.

-

Due to the research and development on rational probabilistic risk/loss assessment methodologies and studies conducted in connection with several important projects, today we have substantial capability to analyses the risk and losses ensuing from low-probability, high consequence major earthquake events.

-

In this regard, the selection of an appropriate set of GMPMs, that are compatible with the regional seismo-tectonic characteristics, and the selectıon of vulnerability (or fragility and consequence) relationships that are compatible with the IMs and appropriate with the inventory of assets in the portfolio are of great importance. The mean damage ratio (MDR) is highly sensitive to the consequence models (i.e. loss ratios assigned to each damage state).

-

The probability distribution function for the loss to a portfolio depends on the spatial correlatıon of the ground motion and the vulnerability of the buildings. The consideration of the spatial correlatıon does not change the mean loss but increases the dispersion in the loss distribution, which can have a profound influence in loss and insurance related decisions. When spatial correlation is considered, the losses at longer return periods increase. On the opposite side, the losses at shorter return periods may be overestimated if the spatial correlation is not included in the analysis.

-

The reduction of the uncertainties in earthquake risk/loss assessment is an important issue to increase the reliability and to reduce the variability between the assessments resulting from different of earthquake risk/loss models. In this connection, earthquake risk/loss assessment models should explicitly account for the epistemic uncertainties in the components of analysis, especially in the inventory of assets and vulnerability relationships.

-

The practice of risk assessment is now established. However, a number of research issues, such as: uncertainty correlation in vulnerability, logic-tree modeling of epistemic uncertainties and treatment of uncertainties in exposure modeling, remain for treatment in future applications.

References

Akkar S, Y Cheng, M Erdik (2016) Implementation of Monte-Carlo simulations for probabilistic loss assessment of geographically distributed portfolio using multi-scale random fields: a case study for Istanbul. In: Proceedings of SSA 2016 annual meeting, Reno, Nevada

Akkar S, Bommer JJ (2010) Empirical equations for the prediction of PGA, PGV and in Europe, the Mediterranean and the Middle East. Seism Research Letters 81:195–206

Akkar S, Sandikkaya MA, Bommer JJ (2014) Empirical ground-motion models for point- and extended-source crustal earthquake scenarios in europe and the middle east. Bull Earthq Eng 12:359–387

ASTM E2026–16A Standard guide for seismic risk assessment of buildings

ATC-13 (1985) Earthquake damage evaluation data for California, Report ATC-13, Applied Technology Council, Redwood City, California, U.S.A

Baker JW (2013) Probabilistic seismic hazard analysis. White Paper Version 2.0.1, 79 pp

Baker JW, Cornell CA (2005) A vector-valued ground motion intensity measures consisting of and epsilon. Earthq Eng Struct Dyn 34:1193–1217

Baker JW, Cornell CA (2006) Correlation of response spectral values for multi-component ground motions. Bull Seism Soc Am 96:215–227

Baker JW, Jayaram N (2008) Correlation of values from NGA ground motion models. Earthq Spect 24(1):299–317

Bal IE, Crowley H, Pinho R (2008) Displacement-based earthquake loss assessment for an earthquake scenario in istanbul. J Earthq Eng 11(2):12–22

Bohnhoff M, Bulut F, Dresen G, Malin PE, Eken T, Aktar M (2013) An earthquake gap south of Istanbul. Nat Commun 4:1999

Boore DM, Atkinson GM (2008) Ground-motion prediction equations for the average horizontal component of PGA, PGV, and 5%-damped PSA at spectral periods between 0.01 s and 10.0 s. Earthq Spect 24:99–138

Bramerini F et al (1995) Rischio sismico del territorio Italiano: proposta per una metodologia e risultati preliminary, Technical report, SSN/RT/95/01, Rome, Italy

Calvi GM, Pinho R (2004) LESSLOSS—a European integrated project on risk mitigation for earthquakes and landslides. IUSS Press, Pavia, Italy

Calvi GM, Pinho R, Magenes G, Bommer JJ, Restrepo-Vélez LF, Crowley H (2006) The development of seismic vulnerabilty assessment methodologies over the past 30 years. ISET J Earthq Tech 43(4):75–104

Chen R, Jaiswal KS, Bausch D, Seligson H, Wills CJ (2016) Annualized earthquake loss estimates for California and their sensitivity to site amplification. Seism Research Letters 87 (8)

Coburn A, Spence R (2002) Earthquake protection, 2nd edn. John Wiley and Sons Ltd, Chichester, England

Cornell CA (1968) Engineering Bull Seismo Soc Am 58:1583–1606

Cornell CA, Krawinkler H (2000) Progress and challenges in seismic performance assessment, PEER Center News Spring, 3(2)

Crowley H, Bommer JJ (2006) Modelling seismic hazard in earthquake loss models with spatially distributed exposure. Bull Earthq Eng 4:249–273

Crowley H, Monelli D, Pagani M, Silva V, Weatherill G (2011) OpenQuake Book. GEM Foundation, Pavia

Crowley H, Colombi M, Silva V (2014) Chapter 4: Epistemic uncertainty in fragility functions for European RC buildings. In: Pitilakis K, Crowley H, Kaynia A (eds) SYNER-G: Typology definition and fragility functions for physical elements at seismic risk: buildings, lifelines, networks and critical facilities,

Crowley H, Pinho R, Bommer JJ (2004) A probabilistic displacement-based vulnerability assessment procedure for earthquake. Bull Earthq Eng 2(2):173–219

Crowley H, Bommer JJ, Stafford PJ (2008) Recent developments in the treatment of ground-motion variability in earthquake loss models. J Earthq Eng 12(1):71–80

Daniell JE (2014) The development of socio-economic fragility functions for use in worldwide rapid earthquake loss estimation procedures, Doctoral Thesis (in publishing), Karlsruhe, Germany

Dell’Acqua F, Gamba P, Jaiswal K (2012) Spatial aspects of building and population exposure data and their implications for global earthquake exposure modeling. Nat Hazards 68(3):1291–1309

Dhakal RP, Mander JB (2006) Financial risk assessment methodology for natural hazards. Bull New Zealand Soc Earthq Eng 39(2):91–105

Douglas J, Ulrich T, Negulescu C (2013) Risk-targeted seismic design maps for mainland France. Nat Haz 65

Ebel JA, Kafka AL (1999) A Monte Carlo approach to seismic hazard analysis. Bull Seism Soc Am 89:854–866

Ellingwood BR (2001) Earthquake risk assessment of building structures. Reliab Eng & Syst Safety 74(3):251–262

Erdik M, Fahjan Y, Özel O, Alçık H, Mert A, Gül M (2003) Istanbul earthquake rapid response and early warning system. Bull Earthq Eng 1:157–163

Erdik M (2010) Mitigation of earthquake risk in Istanbul. In: Seismic risk management in urban areas-proceedings of a U.S.-Iran-Turkey Seismic Workshop December 14–16, 2010 Istanbul, Turkey, PEER Report, Berkeley, USA

Erdik M, Cagnan Z, Zulfikar C, Sesetyan K, Demircioglu MB, Durukal E, Kariptas C (2008) Development of rapid earthquake loss assessment methodologies for Euro-MED Region. In: Proc. 14. World Conference on Earthquake Eng, Paper ID: S04-004

Erdik M, Sesetyan K, Demircioğlu M, Hancılar U, Zülfikar C, Çaktı E, Kamer Y, Ye-nidoğan C, Tüzün C, Çağnan Z, Harmandar E (2010) Rapid earthquake hazard and loss assessment for EuroMediterranean Region. Acta Geophysica 58(5):855–892

Ergintav S et al (2014) Istanbul’s Earthquake hot spots: geodetic constraints on strain accumulation along faults in the Marmara seismic gap. Geophys Res Lett 41(16):5783–5788

Esposito S, Iervolino I (2011) PGA and PGV spatial correlation models based on European multievent datasets. Bull Seism Soc Am 101(5):2532–2541

FEMA (1999) HAZUS earthquake loss estimation methodology. Technical manual, Prepared by the National Institute of Building Sciences for the Federal Emergency Management Agency, Washington DC

FEMA-154 (2002) Rapid visual screening of buildings for potential seismic hazards: a handbook, federal emergency management agency, Washington. DC

FEMA (2003) HAZUS-MH technical manual. D.C., Federal Emergency Management Agency, Washington

Freeman SA (1998) Development and use of capacity spectrum method. Proceedings of the 6th U.S. National Conference on Earthquake Engineering, Oakland, California, EERI

Gamba et al (2014) Global exposure database: scientific features, GEM Technical Report 2014-10, Global Earthquake Model, Pavia, Italy

Goovaerts P (1997) Geostatistics for natural resources evaluation. Oxford University Press, UK

Giovinazzi S, Lagomarsino S (2004) A macroseismic model for the vulnerability assessment of buildings. In: 13th World Conference on Earthquake Engineering. Vancouver, Canada

Goda K, Hong HP (2008b) Scenario earthquake for spatially distributed structures. In: The 14th world conference on earthquake engineering October 12–17, 2008, Beijing, China

Goda K, Hong HP (2008a) Spatial correlation of peak ground motions and response spectra. Bull Seism Soc Am 98(1):354–365

Goda K, Atkinson GM (2010) Intraevent spatial correlation of ground-motion parameters using SK-net data. Bull Seism Soc Am 100:3055–3067

Goda K, Yoshikawa H (2012) Earthquake insurance portfolio analysis of wood-frame houses in south-western British Columbia. Canada, Bull Earthq Eng 10:615–643

Goulet CA, Haselton CB, Mitrani-Reiser J, Beck JL, Deierlein G, Porter KA et al (2007) Evaluation of the seismic performance of code-conforming reinforced-concrete frame building-From seismic hazard to collapse safety and economic losses. Earthq Eng Struct Dyn 36(13)

Grünthal G (ed.) (1998) European Macroseismic Scale 1998 (EMS-98). Cahiers du Centre Européen de Géodynamique et de Séismologie 15, Centre Européen de Géodynamique et de Séismologie, Luxembourg, 99 pp, 1998

Hancılar U, Tüzün C, Yenidoğan C, Erdik M (2010) ELER software – a new tool for urban earthquake loss assessment. Nat Hazards Earth Syst Sci 10:2677–2696

HAZUS (1999) HAZUS earthquake loss estimation methodology. Technical Manual, Prepared by the National Institute of Building Sciences for the Federal Emergency Management Agency, Washington DC

Inoue T, Cornell CA (1990) Seismic hazard analysis of multi-degree-of-freedom structures. Reliab Marine Struct RMS-8, Stanford, CA, 70 pp

Jaiswal K, Wald D, Porter K (2010) A global building inventory for earthquake and risk management. Earthq Spect 26(3):731–748

Jayaram N, Baker JW (2009) Correlation model for spatially-distributed ground-motion intensities. Earthq Eng Struct Dyn

Kale Ö, Akkar S, Ansari A, Hamzehloo HA (2015) Ground-motion predictive model for Iran and Turkey for horizontal PGA, PGV, and 5% damped response spectrum: Investigation of possible regional effects. Bull Seism Soc Am 105(2A):963–980, Apr. https://doi.org/10.1785/0120140134

Kircher CA, Whitman RV, Holmes WT (2006) earthquake loss estimation methods. Nat Hazards Review 7(2):45–59

Krawinkler H (2002) A general approach to seismic performance assessment. In: Proceedings of the international conference on advances and new challenges in earthquake engineering research, ICANCEER, Hong Kong Vol, 173–180